Claims Analytics Use Case

Auto Insights can help insurance teams automate claims performance analysis, drill into claims trends, and spot anomalous claim rates.

This article covers:

Example insights from this use case.

Recommended data structure for this use case.

What Sort of Insights Can Auto Insights Help Me Uncover?

We've outlined some example questions that Auto Insights can help answer through a combination of its proactive insights, Missions, and What caused this? analysis.

Automate claims performance analysis:

Number of Claims by Department

Average Time to Payment by Agent

Number of Claims by Policy Type

Drill into claims trends:

Trend of Claims by Claim Reason in Sydney

Seasonality of Claims

Compare Claim Amounts for Theft in Metropolitan and Regional areas

Average Time to Close Claims by Department and Claim Type

Spot anomalous claim rates:

Average Number of Claims per customer

Claim Amount by Claim Reason in Sydney

Top 20 Claims by Claim Amount and Claim Reason last quarter

How Do I Structure My Data?

Auto Insights requires structured, transactional data, with at least 1 measure (for example, Number of Claims) and 5 segments (for example, Claim Type). In addition, we recommend at least 7 months of data (at monthly or daily granularity) so you can take full advantage of Auto Insights' Unexpected Changes feature.

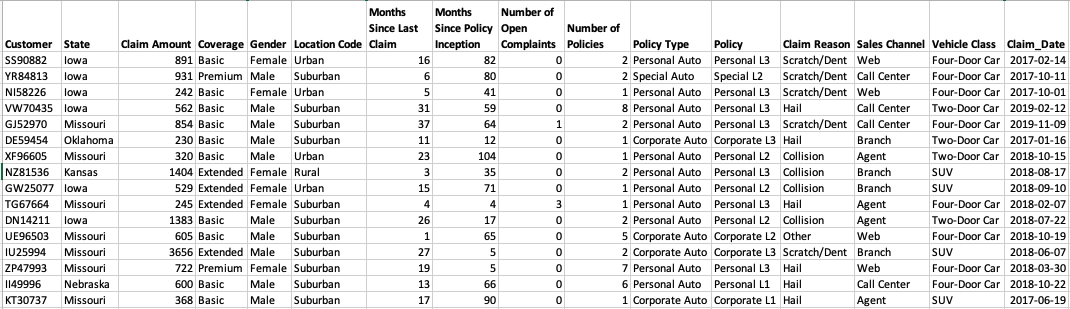

Example Data Structure

Please click on the picture to download a larger copy of the image.

Please refer to Dataset Requirements for more information about data structure.

Segments

Here are some of the typical segments we find in revenue data. A segment is a qualitative value, like names or categories:

Claim attributes: Claim reason, Claim type, Team, Department

Policy attributes: Policy type, Policy name, Months since last claim, Agent assigned, claim channel, coverage type

Claimant attributes: Age, Gender, Location, etc.

Measures

A measure is a quantitative, numeric value. Some of the typical measures include customer ID, number of claims, claim amount, time to close claims, and time to payment.